Apartment players adapt to new norm

Article by Claire Tyrell | Business News

Developers of multi-residential properties are overcoming challenges to push on with projects.

The importance of maintaining solid relationships with builders is not lost on Perth’s top apartment developers.

Those connections are a key part of the puzzle in the local market, where a range of issues has led to reluctance among construction companies to build multi-residential projects, particularly in the traditional build-to-sell space.

Among these barriers are rapid increases in construction costs, which have resulted in builders losing money on some jobs, particularly when coupled with fixed-price lump-sum contracts.

And the need for builders to deal with multiple clients on a single job, as opposed to a single client for a project like a school or hospital, can be a deterrent.

Added to this is the fact there are fewer builders in the market now than pre-Covid, with the industry hit by insolvencies.

However, while the convergence of these factors has slowed the volume of apartment projects in recent years, developers are finding ways around the issues.

Climate

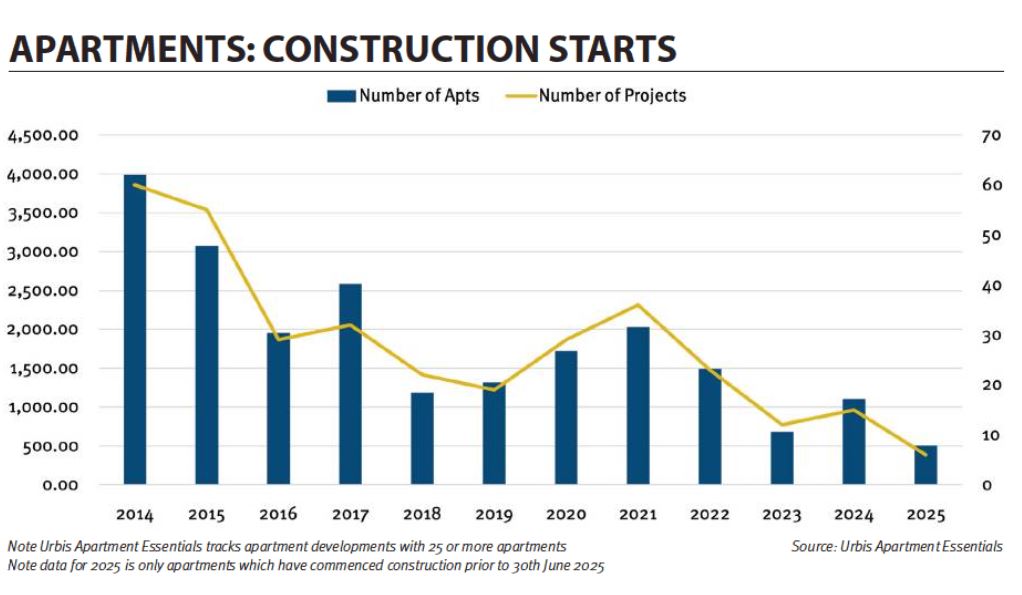

Recent data from Urbis shows that just 19 per cent of Perth apartment projects approved since 2020 are under construction.

Six apartment projects comprising 507 dwellings have started construction in Western Australia during the first half of 2025.

Urbis director property economics and market research, David Cresp, told Business News this was a significant improvement on recent years.

“There are around 800 apartments across seven projects that are working to get under construction in the second half of the year,” Mr Cresp said.

“We expect this year will be the highest year for apartment commencements since 2022.”

Apartment developers are approaching the challenge of securing a builder for their project in different ways, with an increasing number adding construction arms to their businesses.

Edge Visionary Living, which has moved from ninth to second on Data & Insights built form developers list this year, is a prime example of this.

Since adding Edge Construction to its business in mid-2023, the team focused on building at Edge has grown to 40 people.

“That’s more than the development team,” Edge Visionary Living managing director Gavin Hawkins told Business News.

The Subiaco-based developer has six projects valued at a total of $1.22 billion currently under construction, including South Perth’s Lumiere, which has taken a decade to come to fruition.

The 29-storey, $320 million development was launched in 2015.

At that time, it was valued at $190 million.

Planning authorities initially gave the project the green light in August 2015, but that approval was overturned in the Supreme Court of Western Australia the following year.

The project was revised a further three times before it was finally approved in 2020 when the State Administrative Tribunal overturned a rejection by a Joint Development Assessment Panel.

Mr Hawkins suggested it was Edge’s sheer determination that made the South Perth project possible.

“Development isn’t always easy, and it doesn’t always go to plan; but you’ve just got to roll with the punches a bit and find a way,” he said.

“We haven’t been deterred, and we’ve stuck at it.

“We’ve still got buyers from 2015 that just have ridden each of the waves and [are] really happy about being there.”

Edge is also part way through its $375 million The Dunes development in Scarborough, which started as national tier-one contractor Roberts Co’s first project in WA.

However, Roberts Co fell into administration earlier this year, leaving Edge Visionary Living without a builder for The Dunes.

Fortunately, Edge Construction was able to pick up where Roberts Co left off and is now working on the project.

Mr Hawkins elaborated on his company’s decision to bring builds in-house.

“In the past, we would have to go out to four to five builders, all with different levels of appetite and skill sets, and then condense that back to one to two, and then deal with them and negotiate with them to try and get to a build contract,” he said.

“That’s an incredibly long period of time. In the current market [it] can be up to twelve months.

“The fact that now our building company works with our development team at the design phase is incredibly helpful, so it speeds the process up [and] makes it more efficient.”

Golden Sedayu, which is a joint venture between Golden Group and Agung Sedayu, took a similar step to Edge, launching its own construction company.

In March, Golden Sedayu managing director Andrew Sugiaputra described the establishment of Golden Sedayu Construction as a strategic move.

“Starting and financing our own construction company gives us more control over the construction program, quality assurance and improved coordination between in-house departments and consultants,” he said.

“This ensures greater stability in project timelines, helping us deliver on schedule and to the highest standards.”

The Indonesian-backed company has commenced work on its $3.8 billion Burswood Point project, with the ground works on its Somerset East and West apartment towers starting earlier this year.

ADC development director Adam Zorzi (left) and Tim Tjhung say it helped to have an operating supermarket on site. Photo: Michael O’Brien

Timeframes

It is not uncommon for the planning phases of an apartment project to be drawn out, as was the case with Lumiere.

Another project that has taken several years from launch to construction is ADC’s Mos Lane.

The $170 million, 68-dwelling development was conceived in 2018, when the Adam Zorzi and Rod Hamersley-led developer bought the Mosman Park site.

ADC received some pushback from the Town of Mosman Park, which refused a local development plan for the site.

Shortly after this, in 2020, the state government introduced the State Development Assessment Unit, which the developer saw as a far more attractive option than dealing with the local authorities.

Mos Lane was one of the first projects submitted to the Western Australian Planning Commission pathway, which was initially framed as a means to expedite projects of state significance.

However, it was not until 2023 that the project got the green light.

During that time, the proposal attracted criticism from parts of the community opposed to its size and potential impact on the local area.

The cost and configuration of Mos Lane changed considerably over the years, with the developer initially proposing a 100-dwelling project with an estimated $48.8 million build cost.

But as ADC founding partner Mr Zorzi explained, the fact the site contained an operating supermarket (IGA) meant the developer did not lose out during the approvals process.

“The saving grace is we’ve had a trading shopping centre here. So, from a developer perspective [it’s been] … generating income, servicing the local neighbourhood and providing amenity for the community,” he said.

“That’s why we left the demolition as late as possible.”

Icon Construction recently started work on Mos Lane, seven years after the developer bought the site.

Mr Zorzi acknowledged the difficulties associated with securing a builder in the current environment.

“Getting a builder is hard, but the reason getting a builder is hard is because the construction market is so tight,” he said.

“It’s getting the actual trades, finding the granite worker, finding the electrician, finding the plumbers.”

Mr Zorzi said it was increasingly difficult to find builders for jobs valued between $20 million and $50 million, with a lot of developers fighting for the same pool of contractors.

ADC is also currently building a 31-dwelling project in Subiaco and is about to commence work on its 50-apartment Maylands development Lyric on Eighth.

However, its $400 million Perth Girls School project in East Perth has stalled.

Mr Zorzi said ADC was currently in the process of working out how to deliver the school project in stages.

Celsius Property Group also endured a lengthy process to get its Alma Square project in North Perth off the ground.

The $170 million development is days away from starting construction, with Julian Ambrose’s Atlas Building set to take on the 108-dwelling job.

Atlas is a repackaged version of BGC Commercial, which Mr Ambrose, the stepson of the late BGC Australia founder Len Buckeridge, bought last year.

Construction is set to begin on Celsius Property’s $170 million Alma Square project in North Perth. Image: Space Collective Architects

BGC Commercial recently completed Celsius’s Elysian development in Subiaco, which was also mired in planning difficulties.

Celsius Property Group managing director Richard Pappas said maintaining the relationship with Atlas was important.

“We’ve been happy with them and are happy to have them build for us again,” he said.

Mr Pappas recalled Celsius’s long, and at times arduous, journey with Alma Square.

“We’ve invested nearly seven years of our life on North Perth,” he said.

“In seven years … the build price is two and a half times what we would have expected, and it’s probably only in the last few months that the end sales values have lifted sufficiently to make it work.”

By the time work on Alma Square is completed, a decade will have passed since Celsius bought into the project.

Considering the state government wants 47 per cent of homes to come from infill developments, the lengthy timeline for some projects was less than ideal, Mr Pappas said.

“Ultimately, it’s just not realistic to have to spend ten years to develop 108 units in North Perth,” he said.

“Some of that we have to take responsibility for in the context of our planning journey. We could have sharpened that time frame a bit.

“But it’s tough to deliver built form. However, it’s incredibly rewarding and it’s incredibly necessary.”

Environment

Megara director Jamie Clarke is overseeing the $240 million Serai apartment project in North Fremantle and the $200 million Ora project in Sorrento, both of which are under construction.

On both developments, Megara was forced to go back to buyers to lift its prices.

This has been a common occurrence in recent years, as build costs have risen faster than the value of dwellings.

Jamie Clarke says having lasting relationships with builders is key to property development. Photo: Michael O’Brien

In the case of Serai, Megara went back to buyers around 2021.

“It certainly wasn’t profiteering; it was about getting the project feasible,” Mr Clarke told Business News.

Mr Clarke also recalled the challenges associated with securing a builder for the North Fremantle development, with negotiations falling over with two construction companies.

“We were at ECI [early contractor involvement] with PACT, then they took on [Edge Visionary Living’s] Riviere instead,” he said.

“Then we were in an ECI process with Icon, and they couldn’t meet our budget, so we went with West to West Group.”

ABN Group subsidiary PACT Construction is delivering Megara’s Ora project in Sorrento, due for completion by the end of 2026.

Mr Clarke said while locking in a builder took a lot of work, he was not keen to bring construction in-house.

“We’ve been builders,” he said.

“We used to build our own stuff and understand the building industry. We don’t want to be builders again like a lot of developers are.

“We are also mindful of needing to work collaboratively with builders and to establish those relationships with builders over a long period of time.”

Tim Willing, founding director of boutique developer Willing Group, has a different view.

Mr Willing and his brother, Dayne Willing, established Willing Build in 2023 following the collapse of Pindan, which had been working on Willing’s Clifton and Central project.

Willing Group currently has two projects under construction, in Mount Lawley and Coolbinia, worth a combined $120 million.

“I really couldn’t be developing unless we made the decision to do it in-house,” Tim Willing told Business News.

“[It’s] the only way we can continue to do the projects we do.”

Mr Willing said skills shortages and costs had been pervasive issues in the property industry in recent years, but things were improving.

“At least with construction costs now they’re a little more known, and labour costs are still a problem,” he said.

“You’re still seeing pinch points in different sectors. One minute it might be hard to find landscaping people, and the next thing you can’t find ceiling fixers.

“It changes all the time; as long as we’re aware of that.”

Recent data from the Productivity Commission estimates the number of dwellings completed per hour worked by housing construction workers in Australia declined by 53 per cent in the past 30 years.

Mr Willing said he had observed a drop in productivity.

“Say, ten years ago, we might have thought we can build a building like we did at Guildford, [which was] twenty-four apartments … in a year,” he said.

“The same building now would probably take eighteen months to two years.

“It’s just so much longer. So, the time is problematic for developers because then the cost of money is difficult, and that also delays buyers’ decisions because it seems it’s such a long process.”

Mr Willing said off-the-plan sales (sales of apartments before a project is built) had become more of a challenge.

“I thought it was going to get easier to sell off the plan,” he said.

“But because of what’s gone on the past two years, it’s got harder.

“There have been so many bad stories about builders and about people with homes not being finished … [so] they’re just even more alarmed, and rightly so.

“A big advantage we have is that we’re a proven performer and we’ve built a number of projects … we’ve got a strong street presence, and I think that helps in terms of trust.”

Ronald Chan says Finbar Group has sold 143 dwellings, for a combined $147 million so far this year. Photo: Tom Zaunmayr

Affordability

Finbar Group chief executive Ronald Chan offered a different perspective.

The ASX-listed developer, which partners with builder Hanssen on all its projects, has experienced an uptick in pre-sales.

Its $113 million Belmont project Bel-Air was 93 per cent sold at the time of writing.

More than 70 per cent of the apartments at Finbar’s Garden Towers development in East Perth have sold.

Both projects are due for completion in mid-2026.

“We have sold 143 dwellings this year at $147 million, including ninety million dollars of completed stock,” Mr Chan told Business News.

“We’re coming back to a time where a project sells out before completion.

“That was happening in about 2008. The cycle is coming back around, but it has to be the right product.”

Mr Chan said Finbar Group would continue to deliver apartments in the more affordable price range.

This departs from the model currently adopted by most developers in Perth, which is to deliver high-end dwellings primarily targeted at downsizers.

“From a company point of view and a product delivery [point of view], that’s the kind of product we will try and aim for, to try and cater to more of the general market,” Mr Chan said.

“Not everyone can afford the high end, multi-million-dollar apartments.

“If we want to encourage supply and people living in infill, that’s the product we have to [provide]. Not a lot of developers are catering to that market.”

Recent amendments to Keystart legislation should increase the volume of affordable apartments, according to Keystart chief executive Mark Tomasz.

“The change is that there’s a $210 million shared equity product… that’s going to be focused specifically on apartment and townhouses,” Mr Tomasz said.

“It’s really encouraging infill; [we are] really trying to play an active role in helping more apartments come online, to help with supply.”